API Mapping Specifications

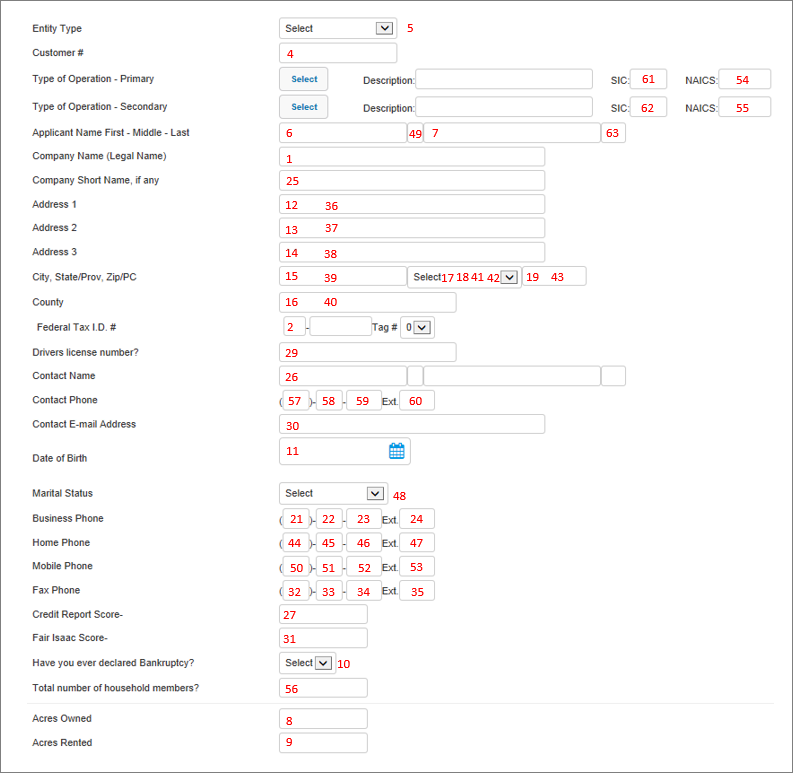

The numbered fields below correspond to the numbers in the screen sample as a reference for data mapping. Not all fields may be included in the General Information setup for the model selected in each record. Certain fields may be particular to specific types of models (i.e. Individual, S Corporation, etc.). For assistance in adding fields to the General Information screen, please contact your system administrator.

Additional Information:

Uploading either the full state name, or the state abbreviation, will populate the state field.

The Entity Type will determine between the business address and home address fields for which data is inserted into address lines 1, 2, and 3 on the General Information screen.

Credit Bureau Score, Credit Classification, and Business Credit Bureau Score fields from the Customer CSV file flow to the Debt Schedule when uploading loans from the core.

Fields with a * are required.

Fields with a + are fields that update from the repository after being inserted initially.

1) Business Name*

2) Client ID*

3) Country*

4) Customer Account Number*

5) Entity Type*

6) First Name*+

7) Last Name*+

8) Acres Owned+

9) Acres Rented+

10) Bankruptcy+

11) Birthdate+

12) Business Address Line 1+

13) Business Address Line 2+

14) Business Address Line 3+

15) Business Address City+

16) Business Address County+

17) Business Address State/Province+

18) Business Address State/Province Abbreviation+

19) Business Address Zip Code+

20) Business Credit Bureau Score

21) Business Phone Area Code+

22) Business Phone Prefix+

23) Business Phone Suffix+

24) Business Phone Extension+

25) Business Short Name+

26) Contact Name+

27) Credit Bureau Score+

28) Credit Classification

29) Driver’s License Number+

30) Email

31) Fair Isaac Score

32) Fax Area Code+

33) Fax Prefix+

34) Fax Suffix+

35) Fax Extension+

36) Home Address Line 1+

37) Home Address Line 2+

38) Home Address Line 3+

39) Home Address City+

40) Home Address County+

41) Home Address State/Province+

42) Home Address State/Province Abbreviation+

43) Home Address Zip Code+

44) Home Phone Area Code+

45) Home Phone Prefix+

46) Home Phone Suffix+

47) Home Phone Extension+

48) Marital Status+

49) Middle Name+

50) Mobile Phone Area Code+

51) Mobile Phone Prefix+

52) Mobile Phone Suffix+

53) Mobile Phone Extension+

54) NAICS Code 1+

55) NAICS Code 2+

56) Number of Dependents+

57) Primary Phone Area Code (Contact)+

58) Primary Phone Prefix+

59) Primary Phone Suffix+

60) Primary Phone Extension+

61) SIC Code 1+

62) SIC Code 2+

63) Suffix+

Additional fields included for Customer Information

The following fields are optional to include in the Customer CSV file, but currently do not map to anywhere in Lending Cloud. They have been made available in preparation for future enhancements to the program.

Bank Number

Farm Involvement

Insiders and Employees

Lending Division

Location Number

Out of Territory

Primary Officer Number

Rating Date

Relationship ID

Relationship Name

Risk Rating

Stock Symbol

Year Began Farming

Year Declared Bankruptcy

The numbered fields below correspond to the numbers in the screen sample as a reference for data mapping.

Additional Information:

Client ID and Customer Account Number are matched with the same fields in the Customer CSV file to link the loans to their respective customer records. Therefore, these fields do not populate anywhere on the Debt Schedule.

Fields with a * are required fields.

Fields with a + are fields that update from the repository after being inserted initially.

1) Account Type*

2) Client ID*

3) Customer Account Number*

4) Loan ID or Number*

5) Number of Payments per Year*

6) Payment Method*

7) Type of Loan*

8) Accrued Interest+

9) Amortize in Months

10) Block Numbering Area

11) Class Code

12) Collateral Code

13) CRA Loan

14) Fixed or Variable

15) High Credit Amount

16) HMDA Loan

17) Interest Payment Per Year

18) Interest Rate+

19) Interest Rate Index

20) Interest Rate Spread

21) Last Payment Date

22) Lifetime Interest Rate Cap

23) Loan Category

24) Loan Purpose Code

25) Low Credit Amount

26) Maturity Date

27) Next Payment Date

28) Original Amount

29) Origination Date

30) Past Due Amount

31) Payment Amount

32) Payment Frequency

33) Present Commitment

34) Principal Balance+

35) Principal Payment per Year

36) Purpose of Loan

37) Risk Rating

38) Term in Months

Additional fields included for Loan Information

The following fields are optional to include in the Loan CSV file, but currently do not map to anywhere in Lending Cloud. They have been made available in preparation for future enhancements to the program.

Amortized Status

Amount Sold

Average Credit Amount

Balance Rated Doubtful

Balance Rated Pass

Balance Rated Special Mention

Balance Rated Sub Standard

Capitalized Interest

Charge Off Amount

Co-Maker

Collateral Description

Collateral Valuation Date

Collateral Value

Date Interest Paid To

Days Past Due

Dealer Code

Dealer Reserve Balance

Escrow Balance

FFIEC Code

Guarantor

Interest Rate Interval Reset

Last Renewal Date

Late Charges

Lien Status

Loan Account Owner

Loan for Sale

Loan Relationship Type

Loss Given Default

Maturity Extension Date

MSA Code

Non-Accrual

Number of Extensions

Number of Payments in Contract

Number of Renewals

Participation Indicator

Participation Sold Original Amount

Periodic Interest Rate Cap

Probability of Default

Shared National Credit

Special Reserve

Times Past Due 30to59

Times Past Due 60 to 89

Times Past Due 90+

Troubled Debt Restructured

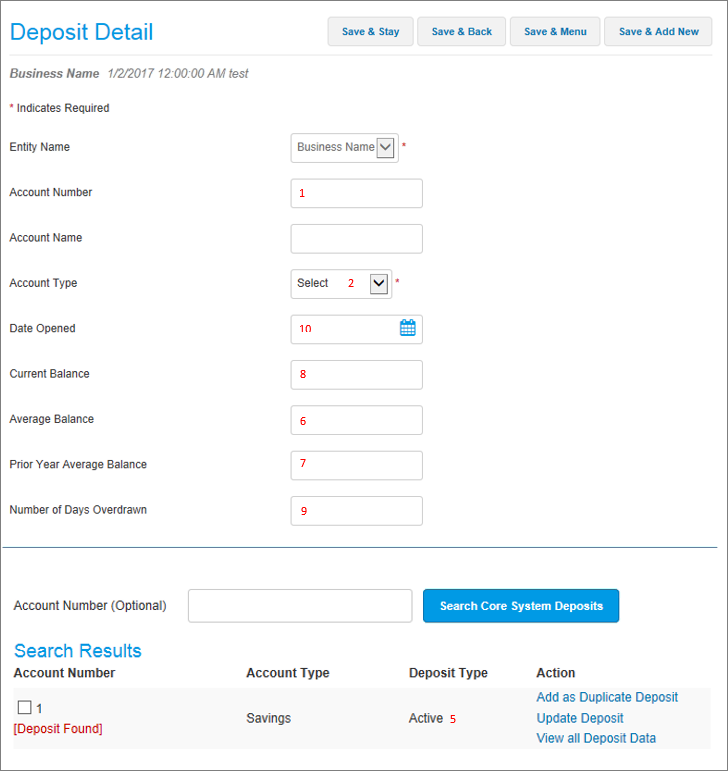

The numbered fields below correspond to the numbers in the screen sample as a reference for data mapping.

Additional Information:

Client ID and Customer Account Number are matched with the same fields in the Customer CSV file to link the deposits to their respective customer records. Therefore, these fields will not populate in the Deposit Relationship or Account Detail screens.

Account Name will populate with Account Type followed by Account Number.

Status shows in the Deposit Type column when searching the core for deposits. It will not populate a field in the Deposit Relationship or Account Detail screens.

Fields with a * are required fields.

Fields with a + are fields that update from the repository after being inserted initially.

1) Account Number*

2) Account Type*

3) Client ID*

4) Customer Account Number*

5) Status*+

6) Average Balance+

7) Average Balance Previous Year+

8) Balance+

9) Number of Days Overdrawn+

10) Open Date+

Additional fields included for Deposit Information

The following fields are optional to include in the Deposit CSV file, but currently do not map to anywhere in Lending Cloud. They have been made available in preparation for future enhancements to the program.

Accrued Interest

ATM

Bank

Closed Date

Deposit Date

Interest Cost

Interest Frequency

Interest Frequency Code

Interest Paid Last Year

Interest Rate

Interest Year to Date

Maturity Date

Officer

Proforma Balance

Relationship Management Officer

Sequence